You may have heard that the path to building wealth is paved with real estate investments. Housing trends nod in agreement. Home values in the U.S. have nearly tripled since 1991 as measured by the

House Price Index. If you’re ready to stop paying your landlord’s mortgage and start building your own equity, then everything you need to get started is outlined below.

The idea of home ownership is exciting but plenty of first-time home buyers have fears about the whole process. Trying to save money for a down payment can feel downright overwhelming. And this is completely understandable in the face of student debt, restrictive entry-level salaries and low-inventory markets.

All of the information contained in these chapters shows you how to get your foot in the door of the housing market (and your first home).

This guide is your one-stop before you shop, where you can overcome all of your first-time home buying challenges with actionable tips and doable strategies.

Let’s get started.

Chapter 1: Build Your Credit From 0 to 700+

Perhaps you strive to live a debt-free lifestyle. Or, maybe credit card

myths have struck enough fear in you to never want to apply for a card. Love them or not, credit cards are like keys that open financial doors while misusing them locks those same doors. Knowledge of interest rates and healthy attitudes towards spending will keep you on track.

And unless you’re an all-cash buyer, having a positive credit history is the first step in getting a loan. Your score goes up with the length of your credit history, so give yourself a head-start by starting this process early.

Many buyers wonder what a good credit score is. While I won’t demystify the whole credit scoring process, the lucky number

700+ and beyond seems to be a good score for buying a home. Below we’ll look at some strategies to establish great credit.

Apply For A Single Credit Card

One is an easy number to manage. Secure one card, then use it to pay one of your monthly bills. Starting with this safe credit-building strategy will keep you in the green zone as a future house hunter. Just be sure to read the fine print on any

offers.

- Treat It Like Hard Cash (Or a Debit Card): Hold off on purchases you can’t immediately afford. If you only have a $5 bill for coffee, then a $10 splurge on avocado toast is out of the question. Apply the same logic to that plastic rectangle in your wallet. A starter credit card is not for avocado toast or any other indulgences.

- Schedule autopay: Autopay is your friend. With autopay, you’ll diligently pay off that one expense every month. You need to show a balance on each monthly statement to be considered to be using credit. Pay off the entire statement balance in full before the due date to avoid interest.

Not Eligible For a Card?

This could be due to income obstacles or having zilch on your credit history. But, like a multiple choice exam, you have options. You will need to explore the best one for your situation. Here are a couple of ideas to get you started:

- Explore Student Credit Card Offers: Look into securing a student credit card to gain financial independence while you’re still living the dorm life. And don’t be tempted by low introductory interest rates. Even if you’re offered a 0% APR, you still need to pay off your balance each month to avoid skyrocketing interest rates after the initial honeymoon offer.

- Become An Authorized User: Another workaround to this challenge involves reciprocal trust. Ask a parent or trusted guardian if they are willing to add you as an authorized user on their card. American Express offers credit cards where the cardholder can establish spending limits for authorized users. Use this approach with caution, because your credit also suffers if the main cardholder misses a payment. Analyze the pros and cons here to determine what’s best for your situation.

Now, a single credit card may not be enough to build mortgage-worthy credit. So what can you do?

Manage 2-3 Credit Cards

Give yourself some credit; you’ve exercised financial control with one card in the steps above. Now let’s graduate to using 2-3 credit cards. Put the cable bill on one card and gasoline on the other. Add a third card for the phone bill for good measure. Use them for necessary expenses that remain steady from month to month. Again, these are not the cards you bring to happy hour. You won’t be leaving too happy if you end up putting a round of drinks on credit.

Finance One Small Purchase

Think of one small purchase you would otherwise be paying for in cash. Are you moving from the dorms to your own apartment and need to buy your own mattress for the first time? Or, perhaps you’ve started commuting to a new job and need to buy a car. Mattresses and cars are the types of purchases that usually come with the option to finance. This is where you can make monthly payments instead of forking over all your cash at once.

Consider making a purchase you can afford the payments on and would already be making anyway. Ideally, make a purchase you can afford to pay for in cash. Unlike houses, cars and mattresses quickly lose value over time. Spending less is better when it comes to these types of purchases.

If you have the cash and finance the purchase solely to build credit, separate the money for that purchase from other funds. This ensures you’re able to make the payments. The idea here is to take the mattress money and put it into an interest-bearing savings account. Then only withdraw as needed to make the payments so you don’t inadvertently squander the money on something else.

Pro tip: you will earn interest.

Chapter 2: How To Budget Like a Boss

A lot of people cringe at the word budget. It just sounds so restrictive. But what if you

saved without completely depriving yourself? Budgeting is a lot like sticking to a successful workout plan. Realistic goals need to be set or else you face burnout. Creating a budget allows an assessment of whether or not you are overspending. And if your income goes up, a budget prevents you from falling into the pitfalls of lifestyle inflation.

-

Calculate basic survival costs. Utilities and transportation costs are relatively fixed costs. Set up autopay on your credit cards to pay these expenses right away. Autopay also has the advantage of allowing you to digitally track any vital expenses.

-

Get sufficient monitoring of your spending. There are plenty of

tech apps you can use to see where your dollars are landing. Alternatively, ask a trusted friend or family member to check in on your budgeting goals.

-

Give yourself a fun cushion. Most people end up splurging occasionally on food and entertainment, which adds up fast. Failure to account for fun makes you feel like you’re always going over, preventing you from taking your budget seriously.

Struggling to create a careful budget as a new college graduate? Feel free to use the example below as a guide and adjust the numbers to fit your lifestyle. According to the Bureau of Labor Statistics, recent college graduates in Los Angeles have an average salary of $55,709. This median figure assumes a minimum annual raise to adjust for

inflation, which was 2.46% for the year 2017-2018.

Food

How you fuel and nourish yourself gets a little tricky. Are you dining out most nights due to a busy schedule? Eating at restaurants tends to be

more expensive than cooking at home because you’re covering the overhead of a business. Make sure grubbing doesn’t senselessly eat up your entire budget:

- Shop the local farmers’ market for savings. Local produce reduces the cost of shipping and seasonal items tend to be more abundant.

- Prep meals on the weekend, then store them in metal containers so they’re ready to go every day.

- Research recipes ahead of time to make a list of what you need.

- Remember, one is an easy number to manage. Shop your local market once a week to keep your spending consistent.

- Have a plan for all items to ensure nothing goes to waste. Use your freezer to stretch the lifespan of perishable products.

Become familiar with the average price of your checkout receipts. You can look over your receipt to see if you’re spending heavily or lean in comparison to the USDA’s

food plan. The highest cost USDA food plan for an individual is $368 per month. A budget of $400 should be enough to feed you well with room to spare for the occasional dinner date.

Gas for Your Car

The price of gas fluctuates, so it’s important to include some cushions here. We tend to only buy as much as we need, so for this budget item, find a pattern to gauge what you typically spend.

- Find out how much you spend in an average week.

- Get an estimate of your car’s average mileage per gallon. Then, use this to determine the number of gallons of gas you need each week. Multiply by the average cost per gallon in your area to get your weekly cost of gas.

- Alternatively, you can reflect back on the recent past and determine how many times you tend to fill up your tank each week. Then figure out how much it usually costs. Play it safe by rounding up (the more you budget for necessary costs, the less room there is in the budget for unnecessary costs).

- Multiply this by 5 to get your budgeted amount. Multiplying by 5 gives you a little cushion.

Let’s say you don’t drive (often) and rely on public transportation or ridesharing. Simply replace gas with your main mode of transportation and apply this same concept. Estimate your weekly cost by walking through an average week in your head. Then multiply by 5 to get your monthly transportation budget amount.

Insurance

This should be easy to budget for. You can’t go without it, and the price doesn’t fluctuate often.

- Look at your most recent policy renewal documents to figure out how much you are currently paying and when your policy expires.

- Drop your current monthly rate into your budget and revisit this to check for price changes when your policy expires or when you start a new policy.

- Check with friends and family to see how much they pay for insurance. If they pay less, then you may be overpaying. If that is the case, shop around to see if you can get the cost down.

- When you are shopping, make sure you are comparing apples to apples. A policy that provides half the coverage is likely to cost less but might not provide the protection you need.

Auto Maintenance

Depending on the type and age of your vehicle, this expense varies significantly. And since it’s not a regular monthly cost, it is difficult to budget for.

- Set aside some cash each month for this since it is a necessary expense. If your car runs in decent condition, plan on an oil change a couple of times a year and another higher-cost maintenance job every year or so.

- The cost of an oil change varies from around $25-$70. A budget of $25 a month comes out to $300 per year, which should be enough for a couple of oil changes and the occasional brake, transmission fluid, or tire change.

- Anything beyond expected maintenance could easily push your average cost of auto maintenance to more than $25 a month. But the idea of building a cushion into each budget item allows you the flexibility to absorb any irregular costs when they crop up.

Utilities

Bills like water or electricity will vary each month. For utilities that vary, look through your recent bills to see your average spending. Your monthly average is the amount goes into your budget.

Are some months higher than others? If so, determine what causes them to be high and see if it’s possible to lower them.

- Avoid or minimize the use of A/C and heating to lower costs. However, budget for an amount you will be comfortable with. If you live in an area where it gets below freezing, then you will probably need to crank up the heater.

- Utility bills — such as cable, internet, and phone — are easy to budget for since they usually stay about the same each month. Just keep a watchful eye on your most recent bills. Even though these usually don’t change, double check each month for unexpected increases.

- Keep your phone bill down by going with a low-data phone plan and connecting to WiFi whenever possible to use smartphone apps.

- Consider cutting the cord to reduce or eliminate cable costs. Paid streaming services are becoming a popular alternative.

Personal Care

Grooming is not only important but necessary in the professional world. Depending on where you live, $100 a month should be enough for a haircut, basic toiletries, and buying new clothes as needed. However, some individuals get by on less than half of that, and others regularly spend twice as much. Think through what you absolutely need in order to meet your minimum standard of comfort. If you’re someone who tends to splurge on personal comforts, set a reasonable limit and leave some cushion to absorb any overages.

Fun Cushion

This is specifically for things you don’t need to spend your money. Let’s include it in the budget to be realistic.

- $200 a month is $50 a week. This should be enough to go out for drinks, see a movie, catch a ball game or indulge in another modestly priced amusement at least once a week.

- Give yourself a limit so you know when to stop. If you blew through your weekly fun cushion going out with your friends one night and they go out the next night — sit this one out. Just remember, there is always next week.

- If homeownership is what you want, keep your eyes on the prize and the fear of missing out will fade into enthusiasm for the life you are working towards.

- Social pressure to go out can be very real. Try getting comfortable with phrases such as, “I’d love to but I can’t afford that right now”.

Chapter 3: Save Up For a Down Payment

Before you start house hunting, you need to have payment lined up. While cash speaks loudest in real estate, most people need financing to buy a place. A down payment is a portion of the purchase price paid in cash. The rest of the purchase price is paid through a loan. Since the purchase price consists of a loan plus a cash down payment, the big question is: how much down?

Decide How Much To Put Down

Traditionally, most people put down 20% of the purchase price. Twenty down gives the most favorable loan terms and eliminates mortgage insurance. However, there are workarounds if this number is too pie-in-the-sky for you. Most lenders require a minimum down payment of just 3% but expect the additional cost of mortgage insurance or a higher interest rate. Going this route means your monthly payments will be higher than putting 20% down. To determine the minimum amount needed to start shopping, look at homes on the market in your area and see what the price range is on the lowest-priced homes that you would consider living in. Then take 3% of that to determine your absolute minimum down payment.

Save money to pay for closing costs

Expect to pay fees to the lender, title and escrow company when buying a home. These typically run about 2%-5% of the purchase price. Appraisals are another out-of-pocket expense you can expect to pay, in addition to any of the seller’s prepaid property taxes. Take 2% of the home price you used to find your minimum down payment to estimate the minimum you need to save for closing costs.

Determine Your Loan Amount

Before you start shopping for a house, find out how much loan you qualify for. The best way to find out is by submitting your information to a lender, who finds out how much you qualify to borrow. However, when buyers think they don’t qualify in the first place, it can kill their motivation to take this crucial step. Even if you have a

gig-type job, you’ll find mortgages work on a case-by-case basis depending on where you go. It helps to understand what lenders are looking for. The main factors that go into qualifying for a loan are:

1. Loan-to-value ratio

2. Credit Score

3. Debt-to-income ratio

Loan-to-Value Ratio

The loan-to-value ratio was already tackled in the previous step when you determined your down payment. The maximum loan-to-value ratio on a conventional loan is 97%; this means that your down payment needs to be 3% of the purchase price and the loan can cover the remaining 97%.

Credit Score

We tackled this in Chapter 1. If you have established sufficient credit and made all of your payments on time, then this should not be an issue. Using 2-3 credit cards, financing and paying off a purchase should do the trick. In general, you need a score of at least 700. It is possible to qualify for a loan with a score below 700, but the pricing will be worse and the lender may require you to have reserves (excess cash left in the bank). There are various free tools out there to monitor your credit score and simulate the impacts of various actions in order to see what actions you need to take to get it above 700.

Debt-to-Income Ratio

This is calculated by dividing your total monthly debt payments by your gross monthly income. The maximum debt-to-income ratio on a conventional loan is generally 43%. To get an idea of the maximum amount of loan you will qualify for, take 43% of your monthly income. Then subtract any debt payments you already have (e.g. auto loan payment, student loan payment, etc.), and what is left is the amount of monthly housing payment you will qualify for. A housing payment includes principal and interest on your mortgage, plus homeowner’s insurance, property taxes — and if applicable — HOA fees and mortgage insurance.

Now let’s look at an example of how to apply the concepts from this chapter to see how much you need to save at a minimum to buy a house. We will look at buying a 1 bedroom 1 bathroom condominium for $249,000. Assume a down payment of 5% and closing costs of 2%, making the total required savings of $17,430. Based on the budget example from Chapter 2, it will take about 21 months to save up to this.

Check out this case study:

- Joan has a salary of $55,709; she represents a person with the average salary of a new college grad in Los Angeles. Her gross monthly income is $4,642. 43% of this is $1,996.

- She has monthly payments of $203 on student loans and monthly minimum credit card payments of $50.

- This leaves $1,743 of gross income to go toward her house payment.

- This $1,743 will need to cover principal, interest, property taxes, homeowner’s insurance, mortgage insurance (if applicable), and HOA fees (if applicable).

- Joan found a one-bedroom condo in Long Beach, California for $249,000. With a 5% down payment, her loan amount will be $236,550.

- She wants a 30-year fixed-rate loan and determines with a simple Google search that the current interest rate on such loans is 4.75%

- The monthly principal and interest payment on this loan, as calculated using Excel or an online calculator is $1,234.

- Mortgage insurance rates can vary, so she gets a quote from a lender which can be done online or by calling. An online calculator can also be used to estimate the cost.

- She gets an online quote from a credit union that reflects monthly mortgage insurance payments of $118.

- Property taxes and insurance will vary depending on the location and type of property.

- The annual property tax rate is currently 1.115% of the assessed property value in Long Beach which comes out to $231 per month.

- Homeowner’s insurance can be estimated at 0.35% of the purchase price which comes out to a monthly cost of $73.

- Since Joan is looking at buying a condo, she will also have to include HOA fees.

- The listing for the property she’s looking at will show the amount of HOA fees at $281 per month.

- This brings Joan’s total monthly house payment to $1,937. This is just below the $1,996 calculated above, which means that Joan should have the income to qualify, assuming she has strong credit and employment history.

n this chapter, you’ve gained more information about saving. You can review Chapter 2 on budgeting to reassess how much you want/need to save on a monthly basis in order to save up enough for a down payment.

Chapter 4: Loan Shopping Tips To Get You Prequalified

In the previous chapter, you determined the minimum amount needed for the down payment and closing costs. Most agents will ask if you’re pre-qualified before taking you to view homes. So before you hit those open houses, you need to get prequalified by calling a reputable lender.

-

-

Try a credit union or boutique mortgage banker who will look at your situation subjectively. New buyers often need to explore unique programs to fit their circumstances.

-

Look up the license of any lender before you start doing business.

-

A real estate agent might also have an excellent lender referral.

-

The lender will take your information and tell you how much loan you qualify for. They provide the buyer and/or the agent with a letter indicating the approved amount. This letter will be submitted to a seller when you make an offer.

Make sure to have your cash down payment ready in an accessible bank account. You’ll need to show proof of available funds when you submit an offer to a seller and will need to make a cash deposit within a short period of time — if your offer is accepted. Once you get a prequalification letter, you’re ready to pick a great real estate agent.

Chapter 5: Winning Strategies For Finding a Great Real Estate Agent

As a buyer, choosing the right agent costs you nothing. But choosing the wrong one might cost you everything. A great real estate agent holds your hand through the process, laying out all your options honestly. The most important tidbit is to find an ethical person who will go to bat for you every step of the way. Emotions should not dictate who joins you in this business transaction. With this in mind, how can you keep your emotions in check as you find “the one”?

It’s More Than a Side Gig

Simply put, a full-time agent has the experience to navigate the nuances of your local market. Sometimes, a relative or friend who doesn’t regularly practice real estate in your area may offer to represent you. If you’re not confident in their skills as an agent, you can ask for a referral instead. They receive a finder’s reward, and you save yourself a potential headache. Here are a few tips to help you find a good agent.

Look for someone who is:

-

Referred to you by a former client. An honest recommendation from a happy client can say a lot.

-

Able to communicate quickly. Try texting or emailing an agent to get a feel for their average response time. Hot homes are often snatched up within a week of being listed. Do you want to miss the perfect place because your agent was too slow to return calls? Do you want offers to be submitted at a glacial pace without proper follow-up? Obviously not. A proactive agent won’t let you miss out on your ideal home.

-

Knows the area intimately. Find out how long they’ve lived in the area. An agent is the eyes and ears of neighborhood market trends. Sometimes, homes sell off the market and these pocket listings are great when the housing inventory is low. A well-connected agent might be able to reach into their own networking pockets to find you hidden, off-market gems for sale.

-

Knows the meaning of the word NO. You shouldn’t feel the heat for passing on a home or feel pressured into making a decision. The agent is there to be a trusted resource and advocate, not a source of stress.

-

Negotiates well. Ask them if buyers in your price point pay over or under the listing price. Listen to see if they have a good read on the market’s temperature. When the new house smell fizzles, you don’t want to feel as if you overpaid for your abode (though you might feel this way no matter what). You need a tough negotiator who knows how to counter-listing agents and can present strong offers. The best thing a buyer can do is stay informed by checking listings online. For instance, if a home is on the market for over 60 days, it’s probably overpriced. Communicate about the market’s price points so you feel engaged in the process.

-

Willing to use technology efficiently. Look for an attractive online presentation of home listings. Do you see appetizing photos that make you want to go view the property? This highlights how well the agent takes care of their seller clientele, and will probably take good care of you, the buyer.

-

Closing transactions in your area. Ask your agent how many transactions they’ve done in the last year. Are they experienced in representing buyers in your price point? How many listings do they have? These are all questions you can ask an agent.

The Seller’s Agent is Not Your Agent

It’s not ideal to allow a listing agent to represent you as the buyer. If you were involved in a minor fender bender, would you rely on the other party’s insurance to represent you, or would you want to have your own policy?

Having your own agent ensures you’re protected if things go awry. Here’s a common home buyer mistake:

1. A buyer romanticizes an online listing.

2. Buyer calls the listing agent to get more juicy details.

3. Agent may offer to double-end the deal if the buyer has no agent.

4. Agent may offer to knock a little off the commission.

5. The listing agent already knows what home to sell to the buyer, so there are no pros and cons weighing on the property.

6. At negotiation time, the seller’s best interest will take priority over the buyer’s.

Any savings will be marginal and will be lost at negotiation time. Bottom line: Find an agent who represents your best interests and is in your corner the whole way through.

Check For Disciplinary Actions

Go online to your state’s licensing board to verify an agent’s record. There you’ll find out just how ethical the agent really is. Scan for any disciplinary actions or revoked licenses. For instance, if you live in California, just plug an agent’s BRE number

here.

Look At Specialities

Just as there are different educational requirements for high school teachers vs. college professors, real estate agents can have specialties that require additional training hours:

- ABR (Accredited Buyer’s Representative): Represents buyers in transactions.

- CRS (Certified Residential Specialist): Awarded only to the top residential real estate agents.

- MRP (Military Relocation Professional): Understands VA financing and permanent change of station moves.

- ALC (Accredited Land Consultant): Specializes in buying undeveloped land.

- SRES (Seniors Real Estate Specialist): Helps buyers and sellers over the age of 50.

See if an agent is a member of the NAR (National Association of Realtors). Part of the qualifications to join is abiding by a higher code of ethics.

Connect With Recent Clients

Ask the agent if any former clients are willing to speak with you. You might be provided with a recent list of sales along with contact information. From there, take a look at what the buyers paid compared to the original listing price. Chatting with past clients will give you a feel for how smoothly the process went.

Chapter 6: How To Find Your Dream House

A big challenge first-time home buyers have is finding a place they can afford while the housing inventory is low. As home values continue to climb, delaying entering the market means facing a more competitive market as time goes on. Depending on where you live, wages can be slow to catch up to the rapid rise of real estate values. Understandably, these obstacles have would-be home buyers worrying if they’ll ever snag their own property. You might have to adjust your idea of a dream abode while watching out for a

property’s red flags. Below are a few strategies to keep you on track.

Stay Unattached

Hot emotions + hot markets = cloudy decision making. So don’t get attached to the first place you see online. Manage your expectations if you don’t want to get discouraged. To keep your cool, double-check the logistics:

- Don’t focus on what you can change (popcorn ceilings) but consider what you can’t change (location). Decide if you can live with what’s impossible to change. If you can’t live with something and can’t change it — this is a deal breaker. Make a list of your deal breakers.

- Look at more homes to gauge how far your money goes, then reevaluate your current prospect.

- Accept that no place may be 100% perfect, so be prepared to compromise.

In a competitive market, you don’t always have the time to mull over a decision. Right around the time of getting prequalified, start visiting homes to familiarize yourself with your housing deal breakers.

Attend Plenty of Open Houses

How can you know what you want, if you haven’t seen what you can get? Online photos and virtual tools only tell one part of the story. Physically pulling up to the crusty curbside of what looked like a pristine property online tells another story. Also, viewing multiple homes can sharpen your buying acumen.

- Open houses offer real intel on what your dollars can actually get you.

- You gain perspective. After seeing a few duds in your price point, that so-called “shack” you passed on now looks historic and cozy.

- You’ll know a deal when you see one and develop an eye for serious issues.

- Visiting a neighborhood allows you to view the parking situation if you own a car or plan on having visitors. You also can visually inspect the condition of the surrounding properties.

Scout the Neighborhood

Visit the prospective neighborhood on a Friday night or Saturday afternoon when everyone is home from work. Check the activity levels of the neighborhood. Listen for any fixed noises, like the regular blowing of a train horn. Can you convince yourself that the whooshing of a busy interstate actually sounds like the ocean at night? Conducting your own neighborhood investigation lets you see (and hear) what will and won’t work for you.

- Look around. Neighbors taking walks and waving to each other can be the signs of a friendly block.

- Listen up. Loud parties and barking dogs might not bother you, but it will for some.

- Test your commute. Drive from the property to your work or vice versa during peak traffic hours.

Make a Compromise

It’s not easy to adjust expectations, especially when a large financial commitment is involved. Everyone wants to feel like they’re getting a good deal. One approach is to view your first property as a “starter home”. You might have to sacrifice square footage and granite countertops to get into the housing market. At the same time, you should be able to envision settling in a place for a few years. For some homebuyers, there is a fear of being stuck with a property. Here are some tips for overcoming the “commitment fears” for those first 5 years:

- Unlike rent, your mortgage payment will not rise over the years. Over time, you will actually be paying less on a mortgage as rent climbs.

- Check the local real estate trends. Have home values generally increased? They probably have. Will you break even if you sell? In a sizzling marketplace like coastal California, you might break even or possibly come out with more equity than you started within as little as a year or two.

- What if you need to move? If it’s not a good time to sell, or you would rather not lose equity in selling costs, you have the option to rent it out. Depending on when you bought, you should be able to break even or at least come close to covering your mortgage payment with rent.

Bottom line: you have options to opt out. But pause the buying plans if temporarily lowering the bar on your living situation is out of the question.

Become Handy

If cosmetic issues are your only deterrent, try to visualize what you’re willing to fix up on your own.

- Home buyers often turn to YouTube for realistic tutorials on minor renovations. Even if a place looks cherried out, you may still end up renovating to personalize your space.

- See if there is room for expansion in the future. You may decide to extend your stay in a starter home.

Check the Livability

The safety of a neighborhood affects resale values and your sense of security. You may want to walk your dog at night or shop in retail stores on foot. Use the tools below to measure how walkable or safe a neighborhood is:

- AreaVibes: This free tool assists your search by displaying a letter grade of the aspects you value most. From education to crime, you can explore maps to gauge the qualities of any locale.

- Walk Score: You can analyze how pedestrian friendly an area is by searching your city.

Grade The Neighborhood

Even if you’re not enrolling kids in public schools, the

National Bureau of Economic Research found a positive correlation between home values and school expenditures. Data aside, what makes a great school will vary from family to family, so it’s important to speak with members of the community.

- Great Schools: Plug in a home address to find the ratings of assigned schools of any prospective properties.

- School Digger: This site gives you comparative stats on how school districts compare to each other in your desired area.

Chapter 7: A House Divided: Choosing Between Condos or Detached Homes

You can go house hunting or you can go condo hunting. Depending on your needs and price point, you might choose a neighborhood that’s suburban, urban, or the in-between — urban. The uprise in urban living has condos in high demand, but some still prefer the liberties found in single-family homeownership. Deciding which style of dwelling is best for you comes down to lifestyle factors and financial feasibility. Keep in mind both possibilities are limited by a buyer’s price point and the market’s inventory.

Condo Pros

- Typically located in walkable areas near retail and transit, allowing some to skip hefty car payments.

- Association fees usually cover the maintenance of a structure’s exterior, roofing, and landscaping for those seeking a low-maintenance lifestyle.

- An HOA may come with resort-style amenities like fitness centers, playground structures, and pools which are costly in a home.

- Cohesive aesthetics are usually enforced; the neighbors can’t create a junkyard next door.

- Barring expensive HOA fees, condos tend to be more affordable than single-family homes.

Condo Cons

- On top of mortgage payments, you pay association fees. These fees are subject to increase to cover extra maintenance costs or lawsuits.

- There’s a lack of freedom. Unit modifications can require a stringent approval process, including additional application fees for any remodeling.

- Breaking any HOA rules can result in monetary fines or disciplinary actions.

- Owners are at the behest of a governing board and all the personalities who run it.

- HOAs can restrict how the unit is occupied, including renting stipulations.

Single-Family Home Pros

- Buyers have total control of the property; changes or remodels (that can improve home values) are not dictated by a governing board.

- Houses with yards have extra breathing room for families, pets, or gardeners.

- Houses tend to offer more storage options with attics, basements, or garages.

- Single-family dwellings can feel more private because walls aren’t shared with neighbors.

- Houses tend to neighbor long-time homeowners, creating stability and a sense of community.

Single-Family Home Cons

- Homeowners are responsible for all maintenance costs inside and outside the property, including fences and landscaping.

- Homeowners need a larger emergency fund available in the event of a sudden disaster, such as a leaky roof.

- There are no amenities offered. Depending on the size of the home, utility bills may be higher.

- Your neighbors can paint stripes on their houses and park rusted cars on their lawns, which can affect aesthetics and the home’s selling potential.

Chapter 8: How To Successfully Close Escrow

Escrow opens the moment an offer is accepted. It closes once all buyer funds have been submitted, contingencies are removed, and the loan funds. Any purchase and sale agreement will typically specify a window of time for the escrow period. When escrow doesn’t close within that window, the seller is free to sell the property to someone else. Here are some tips to keep the ball rolling smoothly:

- Be ready to make an initial deposit within the first 3 days.

- Have payment funds available before escrow opens. Even though it’s typical to deposit most of your funds just before closing, the money should be sitting in an account and ready to go.

- Keep the money still. Moving it around can delay the process by requiring additional documentation.

- There will be a lot of paperwork from your lender, escrow officer and real estate agent — be ready to review and sign documents in a timely manner.

One big obstacle first-time home buyers face is falling out of escrow. Sometimes buyers jump out of a deal, and sometimes it’s out of the buyer’s hands. What are the most common pitfalls for first-timers?

- Failing to get the loan approved

Inspection

Unless the property is a foreclosure, buyers can usually complete a physical inspection of the property. This needs to be paid for out of pocket, but it is a necessary cost to check for issues and defects. During the inspection, you may learn things about the property that are structurally concerning or financially demanding. For instance, the inspector may reveal the exterior is rotting because the land slopes negatively toward the house, causing water to pool at the foundation. Analyzing information like this allows you to decide whether or not a home is a worthy investment. Remember, surprises are great for birthday parties, not home buying.

A standard inspection discloses information about aspects of the property that can be viewed without causing damage to the property (such as opening up walls). The inspection provides all of the information you need, but if you suspect any issues beyond the scope of a standard inspection, you may need to perform additional inspections. Details about the condition of the property in the form of disclosures will come from the seller, the seller’s agent, and your agent. Read these disclosures carefully to see if anything warrants further investigation. Make sure you are comfortable with the issues that are disclosed. Also, if there are a lot of unexpected repairs, you and your agent can negotiate who covers these expenses.

Buyer’s Remorse

Home buying is an optimistic venture and nobody goes into it thinking, “I’m buying now only to regret this later”. However, this can happen. And while it’s impossible to predict future feelings, here’s how to overcome this mental obstacle if you begin to experience cold feet.

- Review Chapter 6, where you’ll find a list of your deal breakers. Viewing a lot of properties gives you the confidence to know you’re making this decision as an informed buyer; not on an emotional one on a whim.

- Overanalyzing the process with well-meaning friends and family may push you towards the “the grass is greener” syndrome. They may have bought their property 10 years ago under different market conditions.

- Unless a home is newly built and turnkey, most properties have some issues. Determine how urgently the repairs need to be addressed and how costly they are (and recheck your budget in Chapter 2). This will help you decide if the property is worth the asking price.

- When concerns are legitimate, you can cancel the contract as long as contingencies haven’t been removed. You will lose the inspection fee, but this is a minimal cost compared to any astronomical repairs you’ll have to contend with when escrow closes.

Loan-Approval Failures

You might think once the offer is accepted, it’s time to purchase furniture for the new home. Don’t get ahead of yourself. Even though your lender has taken your information and issued a prequalification letter, nothing is set in stone until the loan is underwritten and approved.

To ensure your loan gets approved, avoid doing anything to change your financial situation during the escrow period. In fact, this tip should ideally be applied from the moment you are prequalified. If you do anything that changes the factors that were used to get your prequalification, you may no longer qualify. Financial consistency is key.

- Keep the same number of credit cards (don’t apply for new ones or take out a line of credit).

- Don’t make any large purchases (hold off on that new car).

Conclusion

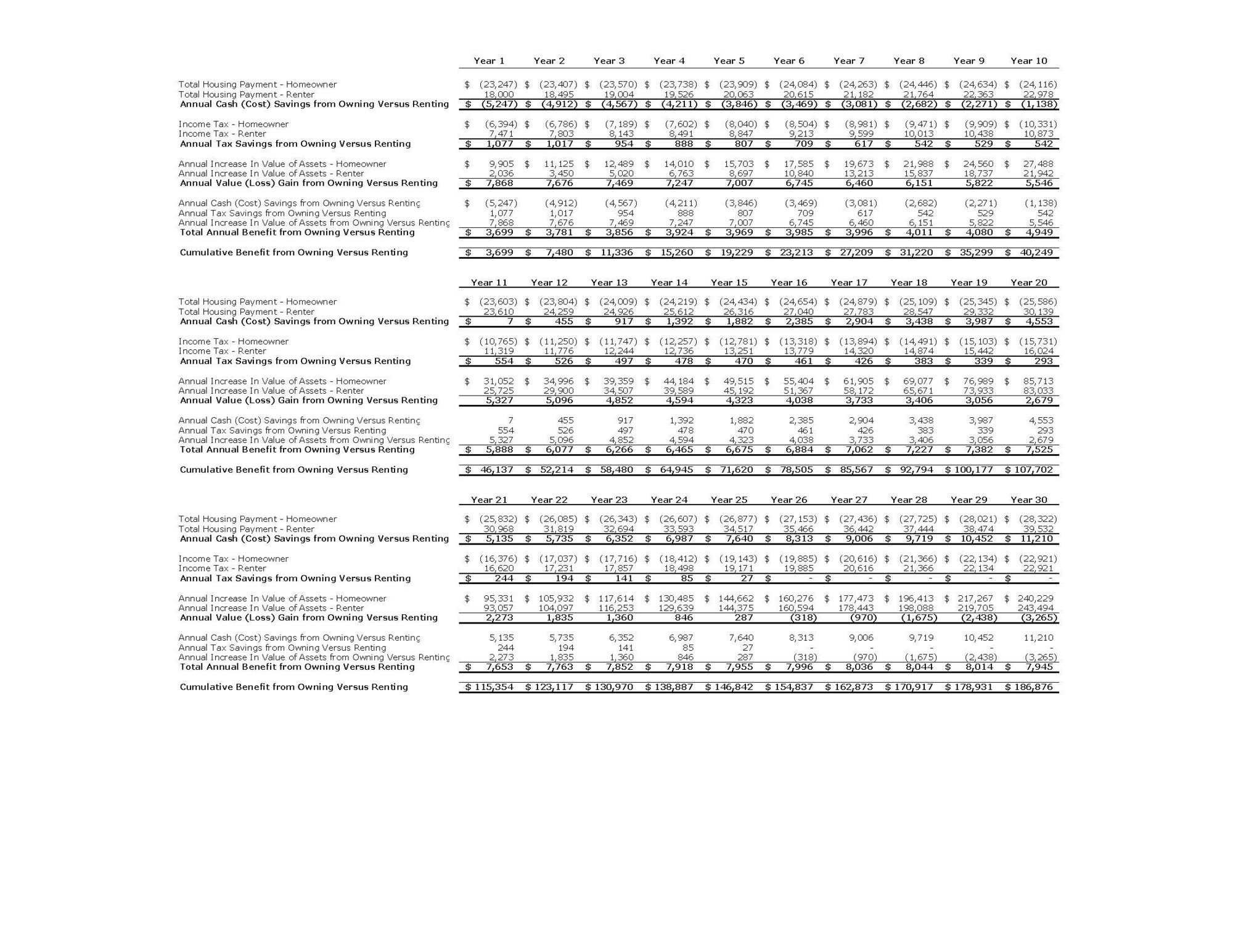

You may be wondering if home buying is all it’s cracked up to be. The answer to that question largely depends upon the outcome of future events. And while we don’t have a crystal ball, we can get an idea of what the future might look like with a few basic assumptions. Returning to our example from Chapter 3, let’s take a look at how Joan’s net worth could grow over time after buying that one bedroom condo. We’ll compare that to how she might fare financially if she were to take her savings of $20,361 and invest it somewhere else.

Below are some assumptions we can reasonably make for the sake of this analysis.

- Inflation: 2.46%

- We will assume that Joan’s income and living expenses (other than housing) grow at this annual rate.

- Increase in rent: 2.75%

- Based on the 2017 fourth quarter PwC Real Estate Investor Survey, the average market rent change for the Pacific Region was 2.75%.

- Increase in home values: 3.86%

- The FHFA’s House Price Index reflects an average growth rate of 3.86% for homes in California for the period from 1991-2018. It’s important to note this includes the period of unprecedented decline fueled by the subprime mortgage crisis, making this a fairly conservative estimate of future price growth. For the past several years, values in California have consistently increased at an annual rate of 7%-9%.

- Increase in values of alternative investments: 10%

- The average annual rate of return for the S&P 500 index from 1928-2017 is approximately 10%. This serves as a reasonable proxy for what Joan can expect to earn on her money if she invests in the stock market instead of housing.

- Taxes can be calculated based on rates in effect for 2018, with the assumption that Joan will take the standard deduction if she remains a renter.

- Mortgage insurance is required to be terminated with the loan balance reaching 78% of the original property value. This will occur 9 ½ years after the loan is originated if all payments are made. Although it may be possible to get rid of mortgage insurance earlier, we will assume it goes away halfway through Joan’s 10th year of homeownership.

- To account for the impact of cash flow differences between renting versus owning, let’s assume that all cash savings in subsequent years are immediately invested in the stock market.

Below is a snapshot of what Joan’s first year as a homeowner might look like if she were to buy that one-bedroom condo for $249,000 versus continuing to rent a one-bedroom apartment for $1,500 per month.

And here is what the next 30 years might look like.

In this example, the benefit from asset appreciation for the homeowner starts to fall below that of the non-homeowner in years 26-30. This will be made up for after year 30 when the mortgage is paid off. The result? The homeowner’s housing payments drastically decreased. Keep in mind this is an estimate, using basic assumptions to simplify a real-life scenario.

While the numbers might show it’s worth it to buy real estate, the real take-home here is to decide what’s best for your situation.

Navigating the roads of home buying isn’t always simple, but the suggestions outlined above can make the journey smoother for you.

Written by Rachel Lurya